Using Mint.com for Monthly and Annual Budgeting

Mint.com is a personal financial program that focuses on budgeting and tracking expenses. Once you signup and link your financial accounts over their secure service, it downloads and syncs your transaction data as well as intelligently auto-categorizing them. You can create and manage financial goals as well as setup alerts.

I started using mint around the time I started college, and it was fundamental to building positive and intelligent personal finance habits and still is an important tool to me today.

“Many people take no care of their money till they come nearly to the end of it, and others do just the same with their time.” - Johann Wolfgang von Goethe

Reasons to Have a Budget

You become more aware of where you're money is going

By having a budget and actively maintaining it, you can more actuarially determine how much money you are spending and on what.

Better ability to spend within your means

With your budget in place, you can plan around how much money you have or that you're earning to spend within your means.

Prepare for Financial Emergencies and Unexpected Costs

Set savings goals to have an emergency fund to be used only for big unexpected expenses or if you lose your main source of income for a period. An Emergency Fund should be able to cover three to six months worth of your monthly costs.

Plan and Stick to your Financial Goals

A budget can help you plan and stick to your financial goals by keeping your spending habits focused and purposeful.

Manage Debt

If you have debt or need to take on debt, a budget will help you manage your debt from getting out of control as well as helping you calculate how much you need to save to pay off your debts promptly without paying too much interest costs.

Expose Bad Spending Habits

Through monitoring your transactions, you can observe your spending patterns and find any wasteful spending. With that information, you can construct a better budget to help you save more.

Build Wealth

The more money you save, the more money you have to potentially invest. It takes money, to make money.

Concerns People Have About Budgeting

It takes too long

Yes, there can be a time upfront cost in setting up a budget, but after your plan and or system is in place, it takes very little effort to maintain and update your budget. Reviewing it is also made simple but graphs and other reports to help you spot trends and other problem areas very quickly.

I don't have money, what would I budget?

Having a small amount of money means you're more vulnerable to financial shocks from sudden high costs. You may also have bad spending habits that are keeping you more cash drained that you need to be, and a budget would help you spot that.

I have a lot of money, why do I need to budget it?

If you have some money, you may find yourself in a situation where your expenses start to rise the more money you make and then you'll find yourself in the situation where you have very little money.

I'm afraid of what I might find out, I'd rather not know

By not knowing, you give up control of your money and then the flow of money starts controlling you. Reality hits hard sooner or later, the quicker you address your personal financial problems, the less painful it will be.

“If money management isn't something you enjoy, consider my perspective. I look at managing my money as if it were a part-time job. The time you spend monitoring your finances will pay off. You can make real money by cutting expenses and earning more interest on savings and investments. I'd challenge you to find a part-time job where you could potentially earn as much money for just an hour or two of your time.” - Laura D. Adams, Money Girl's Smart Moves to Deal with Your Debt

Budget Categories

Here are some budgeting categories to organize your expenses:

- Auto & Transport

- Auto & Transport: Public Transportation

- Bills & Utilities

- Bills & Utilities: Subscriptions

- Education: Student Loans

- Entertainment

- Food & Dining

- Food & Dining: Fast Food

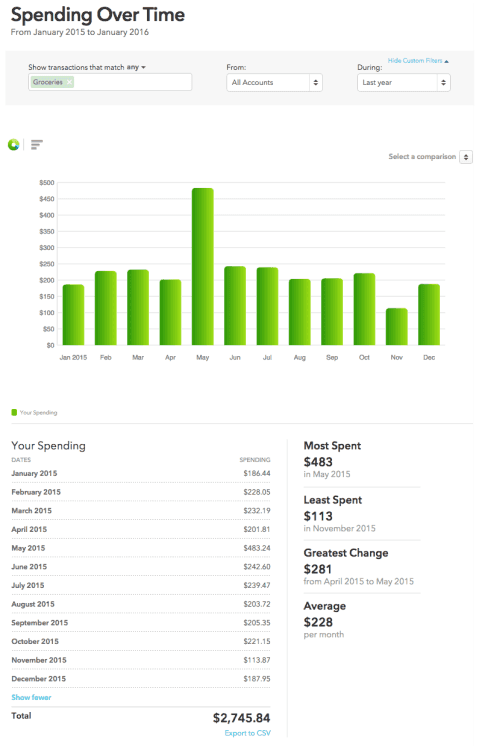

- Food & Dining: Groceries

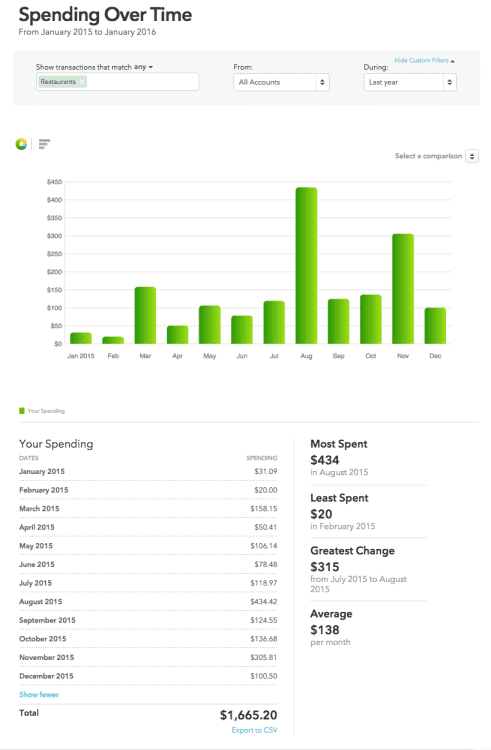

- Food & Dining: Restaurants

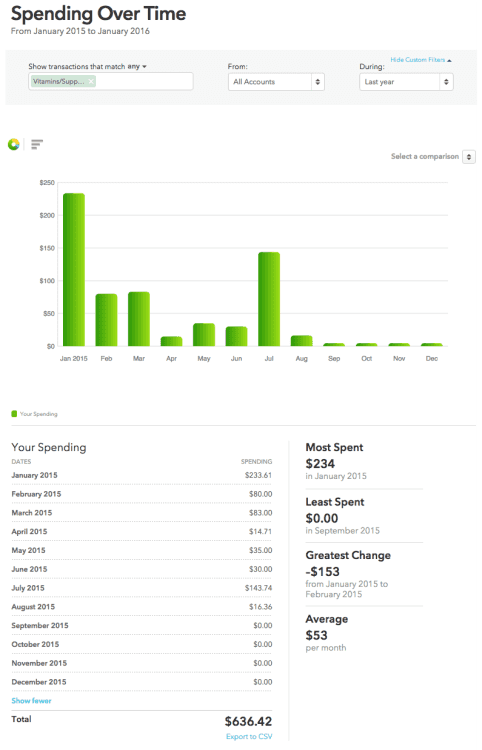

- Food & Dining: Vitamins/Supplements

- Health & Fitness: Gym

- Home: Home Supplies

- Home: Mortage & Rent

- Personal Care

- Shopping

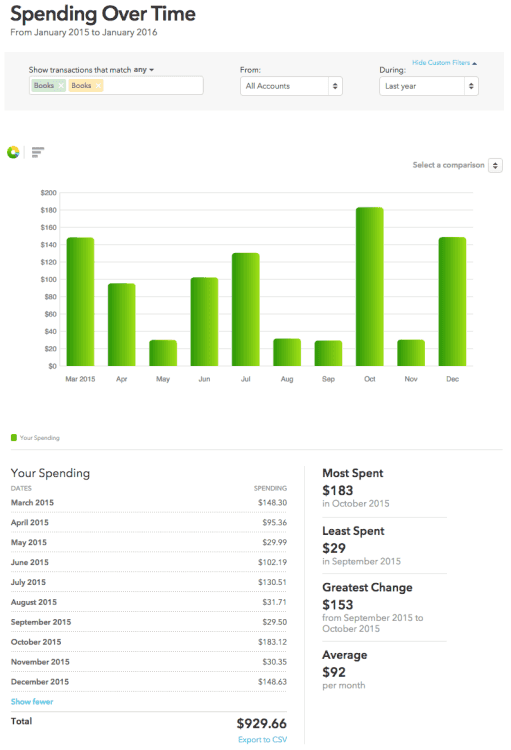

- Shopping: Books

- Shopping: Clothing

- Shopping: Electronics & Software

- Travel

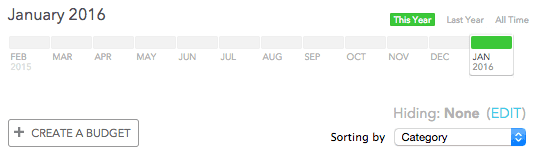

The Budget tab is where you view and create your budget.

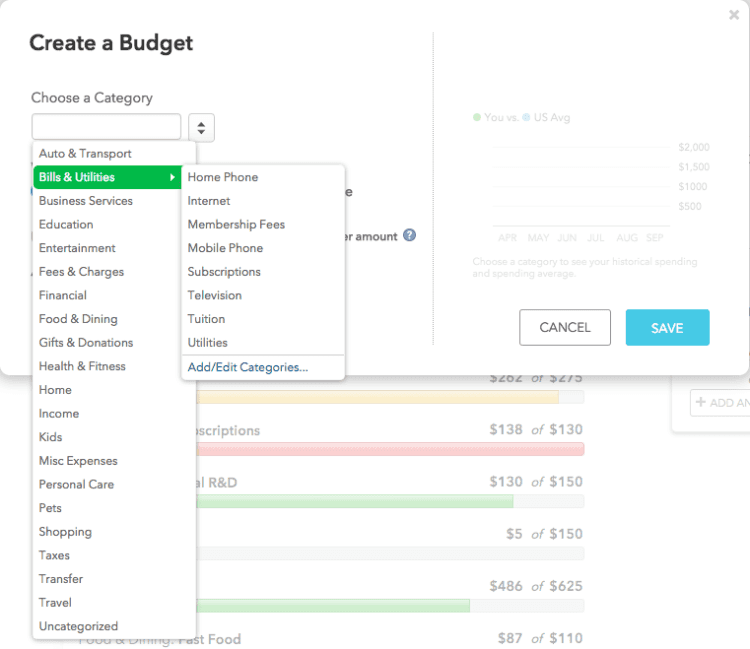

Mint provides many categories to choose from. The sample categories I've listed earlier in the post also common from this list.

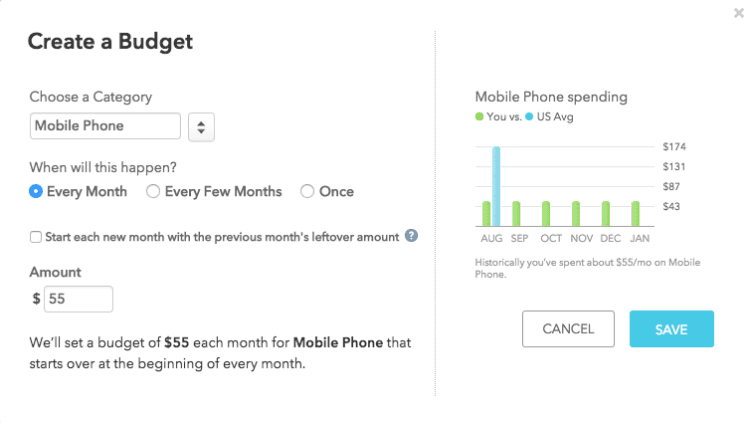

When you create a Category Budget, you can specify how often mint should track: Every Month, Every Few Months or Once.

Mint also shows some comparison data from the amount you spend in a category compared to the US average.

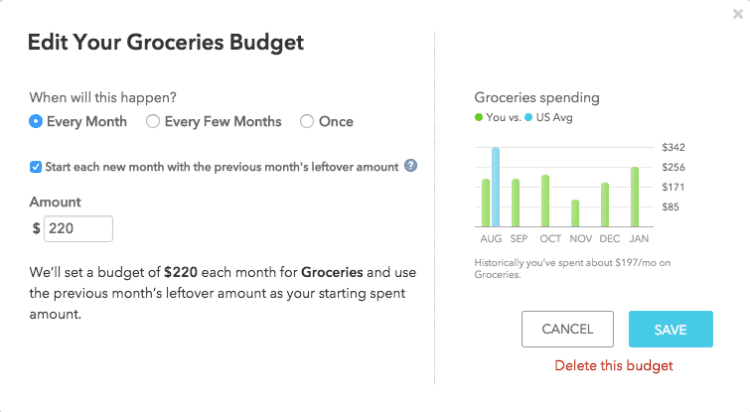

In your category budget, you can choose to rollover and leftover amount of overspend into the next month. I select this option for most of my categories. The few that I don't are for costs that don't change much, like Rent or Gym memberships.

Alerts

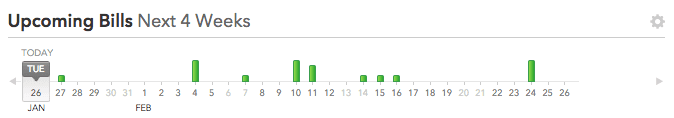

Mint provides a useful timeline view of your upcoming bills with bars are varying height that indicates the significance of the cost.

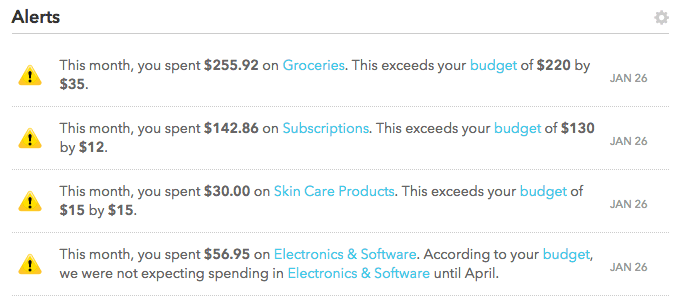

You can configure your notifications to get alerts on when you exceed your budget in separate categories. Email or Text Notifications are available, so you don't have to spend too much time actively monitoring your budget.

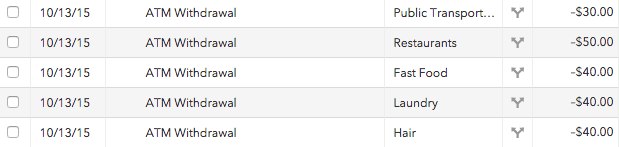

In the transactions view, you can re-categories certain transactions and split single transactions into multiple spending categories. I use this a lot for ATM withdrawals or Amazon Purchases.

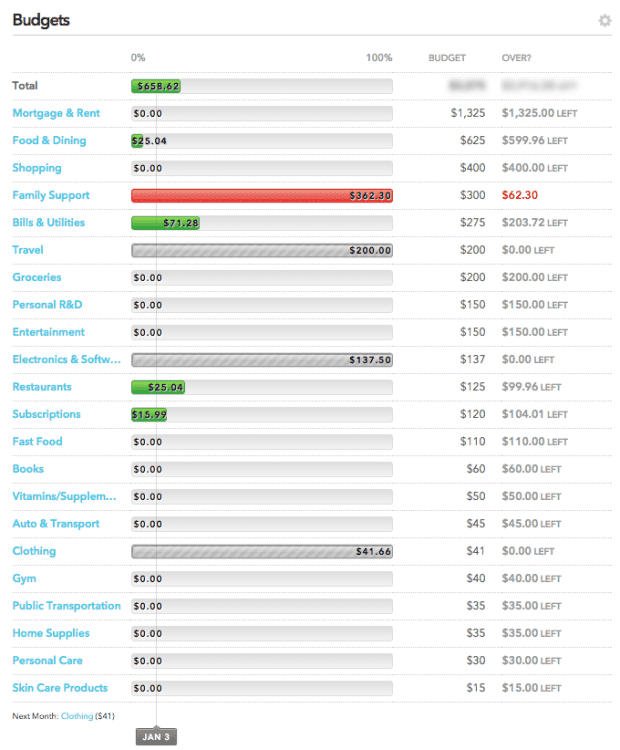

Complete Budget

For educational purposes, I've shared my personal Budget and Expenses.

I choose to utilize more specific spending categories so I can budget more accurately and better control costs. I've added some buffer to various spending categories, so I am less likely to go over budget; give your budgets some slack for unexpected costs. I use the rollover feature to have saved money transfer over to the next month to absorb costs.

When I go about making a budget, I start with a savings goal in mind as a percentage of my income. After I've calculated how much money I have left after savings. I then budget for my fixed expenses (expenses that don't change much). Next is estimating my variable expenses, the other expenses that change a lot like shopping or food spending. Then you're left with net income, the amount of money remaining, after all, expenses. Net Income can be added to savings, which have been kept separate, although they still show up under total net income. You use this money to invest or add to your financial goals and other aspirations like travel.

Savings Target = Income x Savings Rate

Income - Savings Target = Spendable

Net Income = Spendable - (Fixed Expenses + OtherExpenses)

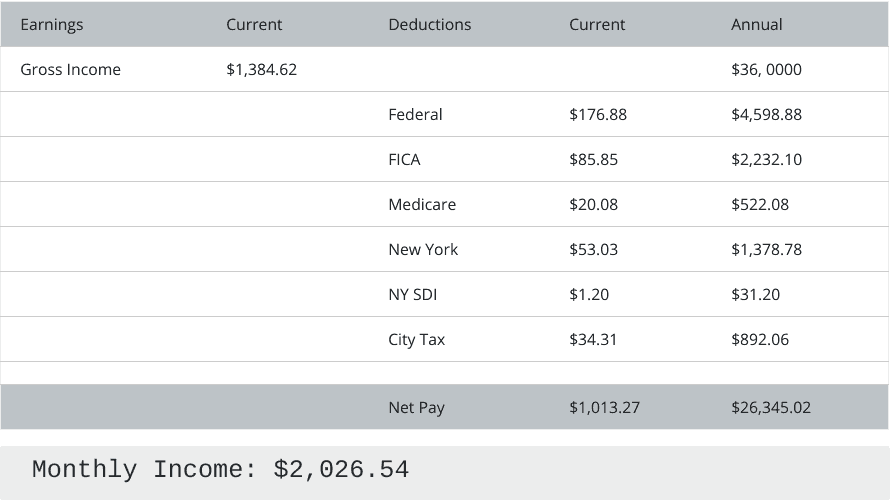

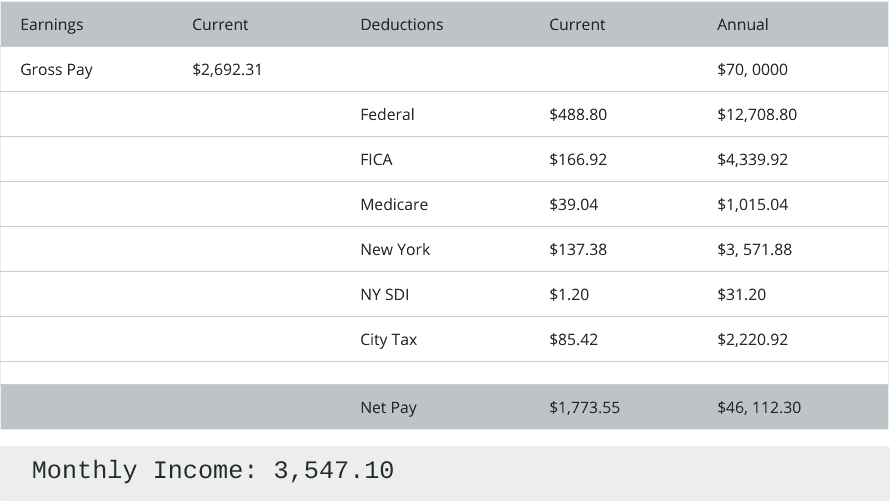

Here are some other income specific budget examples with paycheck data generated from ADP's Salary Paycheck Calculator.

Individual Making 36k

Rent: $1,000

Bills & Utilities: $155

Phone: $60

Groceries: $150

Fast Food: $125

Restaurants: $100

Public transportation: $116.50

Entertainment: $60

Personal Care: $50

Total Expenses: $1941.50

Net Income (Earnings minus expenses): $85.04

EXPENSE RATIOS

- Rent is 27% of Annual Gross Income which is close to the 30% Baseline for having an affordable Home/Rental

- Rent is 49% of Monthly Income (after taxes)

- Food is 17% of Monthly Income (after taxes)

- Bills are 10% of Monthly Income (after taxes)

- Transportation is 5% of Monthly Income (after taxes)

Rent and food are usually the two costliest categories in a budget.

EXPENSES WITHOUT RENT (LIVING AT HOME)

- Paying of Loans at $500 per month

Alternative Total Expenses: $1441.50

Net Income: $584.50

Individual Making 70k

Rent: $1,600

Bills & Utilities: $200

Phone: $80

Groceries: $225

Fast Food: $175

Restaurants: $150

Public transportation: $116.50

Taxi: $100

Entertainment: $125

Personal Care: $100

Total Expenses: $2871.50

Net Income (Earnings minus expenses): $675.60

EXPENSE RATIOS

- Rent is 22% of Annual Gross Income which is a bit below the 30% Baseline for having an affordable Home/Rental

- Rent is 45% of Monthly Income (after taxes)

- Food is 15.5% of Monthly Income (after taxes)

- Bills are 7% of Monthly Income (after taxes)

- Transportation is 6% of Monthly Income (after taxes)

Analyzing Your Spending Habits

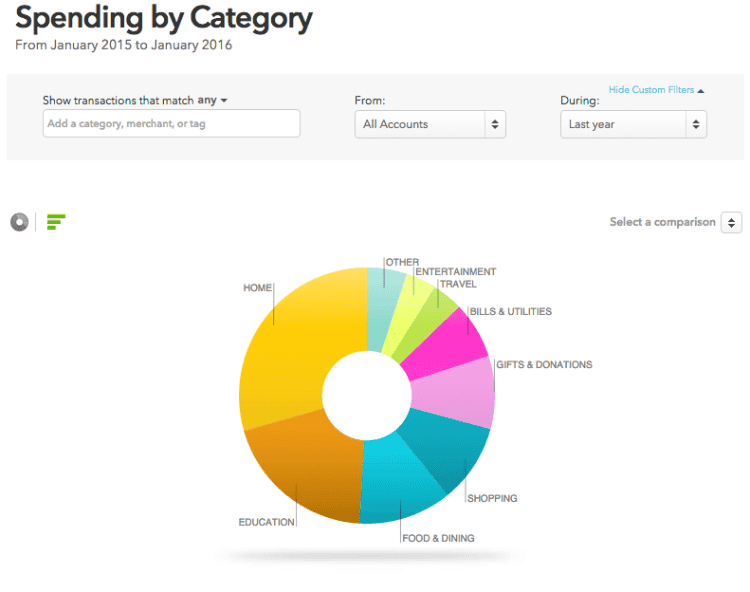

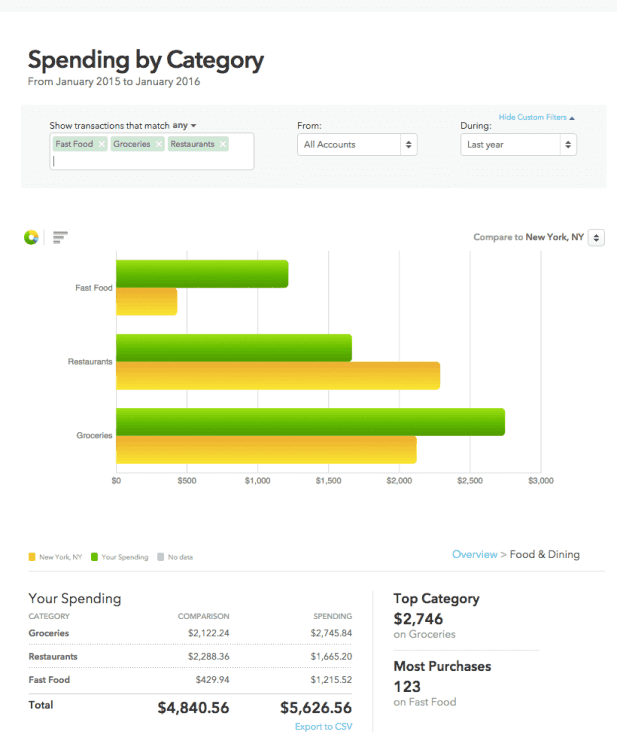

Annual Spending By Category

A pie chart overview of my spending by category for the year of 2015. It helps to visualize your primary expenses as well as other areas in which you may have spent more than you expected to.

Food and Dining are my costliest variable expenses, and I am working to control my grocery and fast food spend. Buying groceries in bulk more and being more mindful when I buy lunch at work should help. I may also consider cooking extra food to occasionally bring to work to save on cost.

For the most part, I have had my restaurant spending under control. I had a special case in August with a spike in restaurant spending which coincided with when I was starting to going on a ton of dates. I settled down in the winter.

Sharp spikes in spending seem to do the most damage to a budget. By understanding the situations in which they occur you can be more proactive and mindful in preventing them in the future.

I use the average spend per month, to help me make more accurate budget allocations for a category the following year and over time.

The pattern for my Vitamin and Supplement spending is that I buy in bulk at the start of the year to save on money and minimize frequent purchase, and I restock around the middle of the year.

I read a ton of books. Still, each year I have been able to decrease the annual cost of my book purchases by buying used, in bulk, or on discount subscriptions.

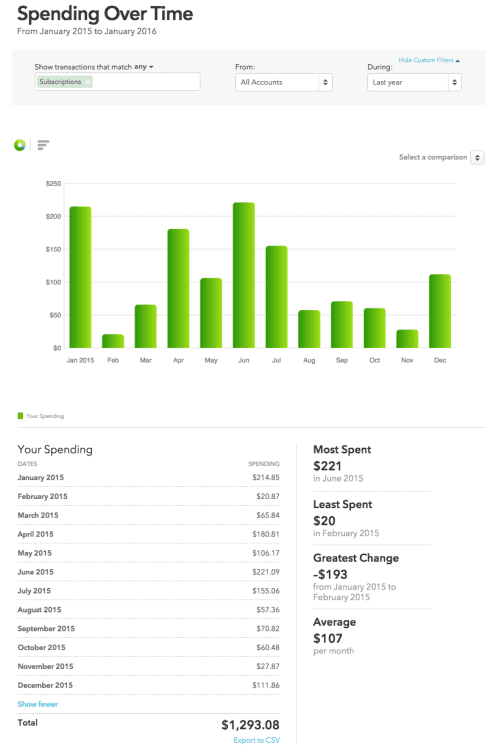

After Food spending, Subscription spending is an area that I am closely monitoring. With many Internet companies switching to subscription-based models, all those $10-$20+ subscription costs add up. For me, that came up to almost $1,300 annually and around $110 per month. I will be doing some serious prioritization on the subscriptions I use and try to take advantage of annual subscriptions to save on costs for my most used services that provide that kind of plan.

Credit Cards and Budgets

A credit card can be a very useful tool for budgeting. First off, don't think of having a credit card as an extension of your income, think of it as insurance on the cash you already have. A credit card should protect the cash you freely have access to. So if your budget is $2,000 and you have a credit limit of $4,000, you should only spend up to $2,000 on credit as a way to ensure you can always have access to quick cash if you need it.

Only go over your budgeted amount in emergencies or special circumstances. If you have a sudden expense, and you have spent primarily on credit, you can defer your credit payments while you still have your cash as the fallback. If you spend with cash and have limited access to more credit, you will be in a more costly situation.

Spending primarily on credit while spending within your budget limit with a card that has favorable rewards programs is almost like free money.

Recap

- Budgeting is a fundamental step in personal and financial responsibility

- By tracking your money, you can better manage it

- Set up a monthly budget with some added buffer in certain spending categories

- Review your budget every 1-2 weeks

- Observe your spending trends every 3 months and annually

- Refrain from updating your budget to cover up overspending in a particular category

- Be proactive in updating your budget with spending you expect to happen or from quarterly and annual trends

- Credits cards don't mean you have more money, use them to protect/cover existing cash

- Budget with a purpose and don't forget to live a little

Money should be mastered, not served. - Syrus, Maxims

Check out mint, a better way to manage your money and stop money leaks.

Comment down below if you have any questions or remarks!

#budgeting #mint.com